Chapter 3: Earning Visibility Without a Platform

What about everybody else? Those who are not riding astride a platform?

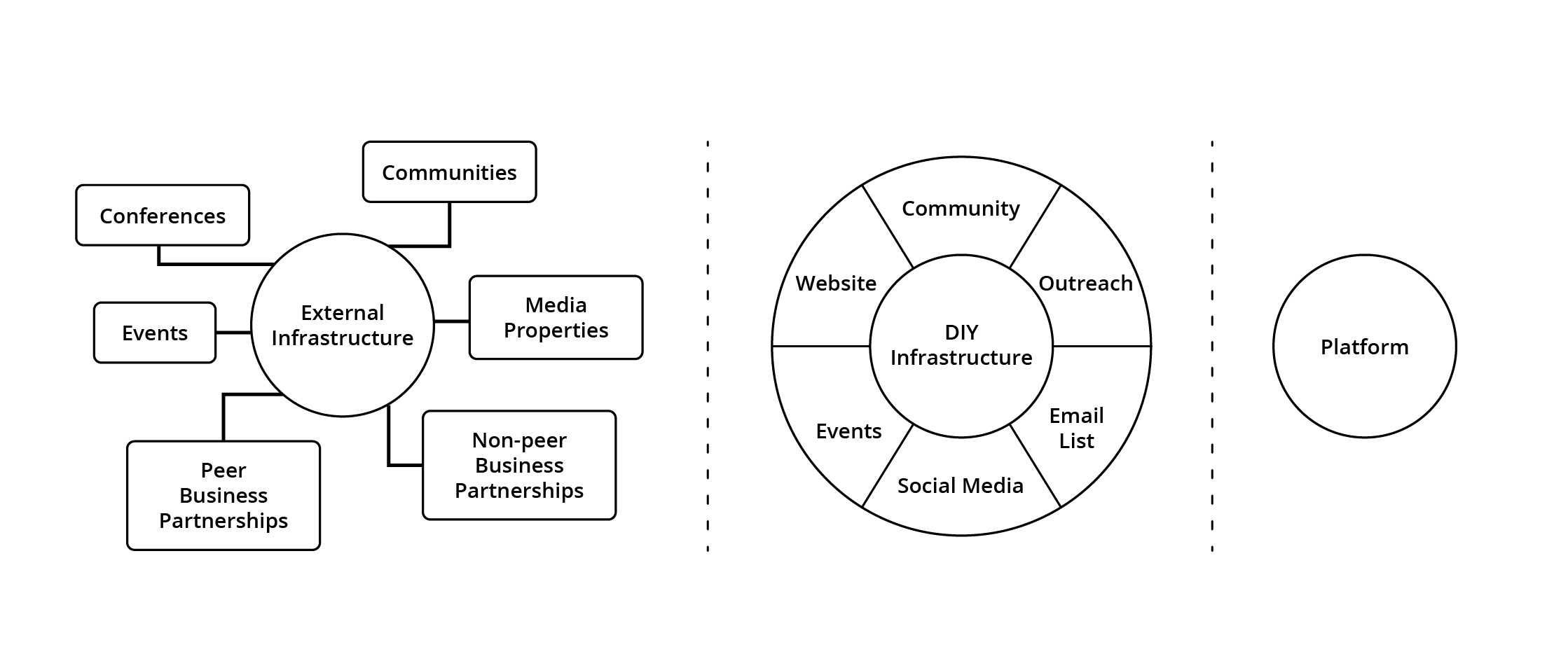

When we look closer at the non-platformers, we see two subgroups. The first seems to have some kind of external infrastructure they use to earn visibility. So does the second, but the second group has built their own infrastructure for visibility. We can think of the first group as using off-the-shelf rented infrastructure to earn visibility, and the second as building their own infrastructure.

Rented Infrastructure

I have a client who generates about $400,000 a year in consulting revenue. He employs one assistant, works out of a small home office, and has no website. He spends a lot of time on other people's stages, though, speaking at conferences and other events. He uses their "infrastructure" to earn a significant amount of visibility for his work.

He doesn't "own" this infrastructure the way he would own his website or email list, but he has good access that allows him to use other people's infrastructure to create economic value for his business. The conferences, communities, and events that other people have convened are a good example of external infrastructure that indie consultants can use to earn visibility.

Media properties are another good example. These include trade publications which can range from print to pure online publications like a podcast, website, or YouTube channel. Often, these media properties are owned and operated by industry associations. You can see a quick example at nam.org, the National Association of Manufacturers. It's both a marketing site for the association and a media property that (hopefully) provides valuable content for the manufacturing industry. Some of that content will come from NAM employees and partners, and some will come from indie consultants who contribute articles, reports, white papers, and similar content in hopes of earning new visibility from the ~14,000 member companies that NAM represents.

Sometimes the external infrastructure is less formal—but not less substantial—when non-platformers partner with other businesses to earn visibility. Those other business may have a similar business model. One indie consultant partnering with another to earn more visibility. Peer businesses, in other words.

Those other businesses may have a very different business model. An indie consultant friend of mine does a lot of public speaking, mostly on stages at conferences for the industry he serves, but sometimes he speaks at online events for an audience-driven businesses like thefutur.com. My friend's business model is quite different than The Futur's model (an online education platform for creative entrepreneurs), so they're not peer businesses, but he benefits from the visibility that he earns from the external infrastructure The Futur provides him access to.

DIY Infrastructure

The other subgroup within the non-platformers group has built their own infrastructure for earning visibility. They might have done this out of preference, lack of access to external infrastructure, or in combination with access to external infrastructure. DIY infrastructure is not an either–or proposition.

They may have figured out how to help search engines like Google connect people who need answers with their website. Search engine optimization, in other words.

They may have built an email list of people who are interested in hearing from the consultant and they send free articles meant to provide value to this list.

They may have created their own community or events that help them earn visibility. Another indie consultant friend of mine convenes a CEO breakfast a few times a year. It's a sort of "pop-up community" sourced from his personal network and augmented by the personal networks of those he invites, and it regularly leads to greater visibility and opportunity for him.

Others have figured out how to use outreach—often with email or LinkedIn, but sometimes physical mail or the telephone network—to earn visibility. The ones who succeed here combine extensive research and an all-out effort at relevance in their outreach in order to earn visibility, and they tend to focus on what is known as a market vertical.

And yet others leverage the low barriers to connection, wide reach, and ability to casually strike up conversations on social media to earn visibility. These last two forms of DIY infrastructure—outreach and social media—do rely on external infrastructure, but that infrastructure is more like a utility or a toolbox; it is inert until it's used for some purpose.

To recap, the non-platformers who have succeeded at earning visibility for themselves fall into two subgroups:

-

External Infrastructure

-

Conferences

-

Events

-

Communities

-

Media properties

-

Peer business partnerships

-

Non-peer business partnerships

All of the above are "owned" by someone other than the indie consultant who is "renting" that infrastructure.

-

DIY Infrastructure

-

Website

-

Email list

-

Community

-

Events

-

Outreach

-

Social media

In the DIY subgroup, the consultant puts in the work to build up the infrastructure for visibility, and while they may not fully control the resulting community or social network, they "own" it more than those in the external infrastructure group do.

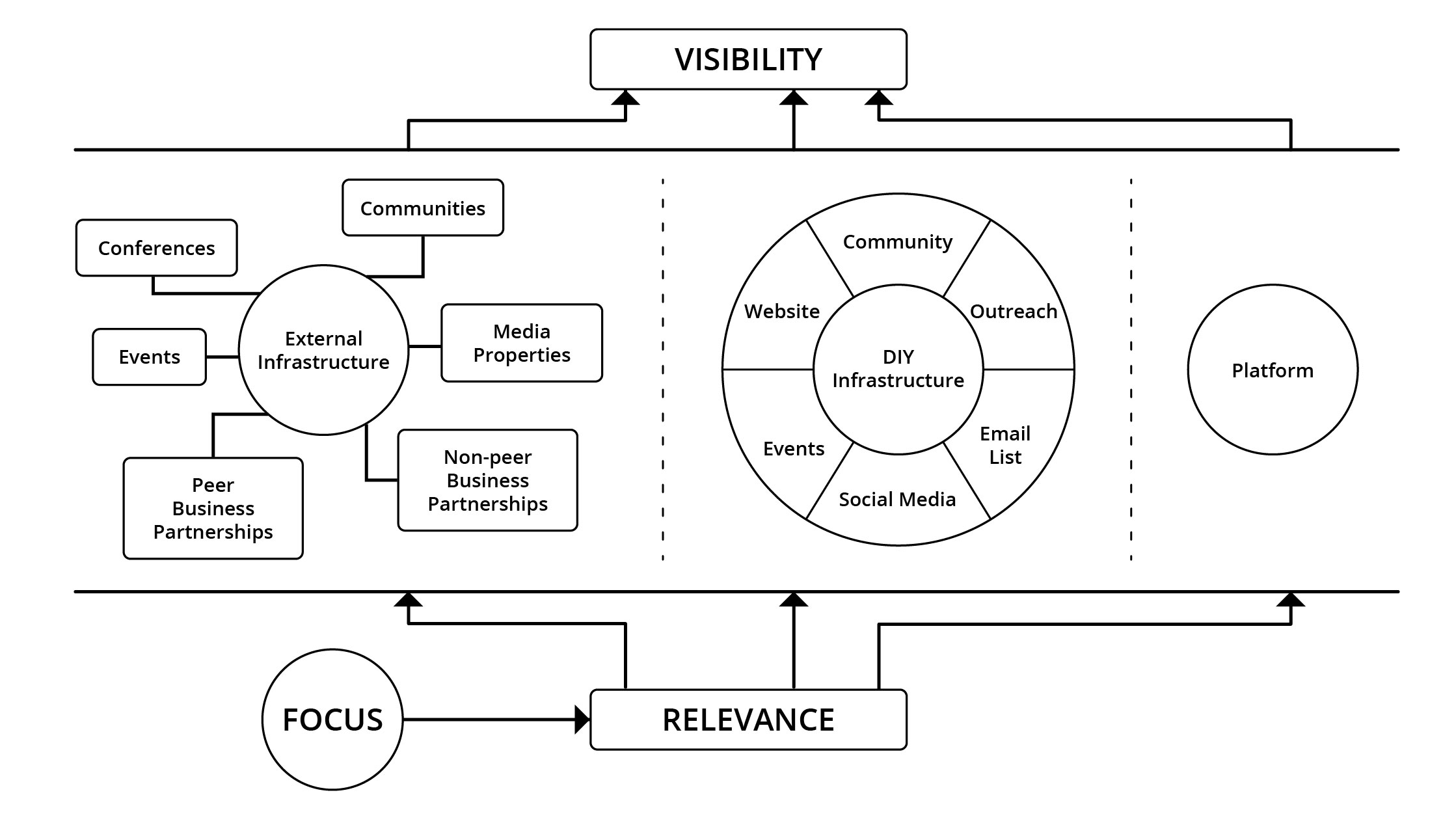

The Importance of Focus

What is generally true about these three groups—the platformers, the external infrastructure leveragers, and the DIY infrastructure builders? Two things.

1) The platformers seem to have the most help earning visibility. The platform does a lot of the work for them. The DIYers have the least help, and they do most of the visibility-earning work themselves by building their own infrastructure.

2) The non-platformers who are successful at earning visibility have made a decision about focus . That focus might be hyper narrow, or it might be somewhat broader, but the focus rarely is 100 percent generalist.

They have made this decision about focus because they must .

Attending conferences or events is a waste of time and money if they do not know who they are trying to connect with.

Participating in communities is awkward if there is no shared interest, so our non-platformers who are successful at earning visibility have invested in clarity about what they are interested in and willing to focus on.

Media properties are not interested in publishing their content if it is not relevant to the audience, so these non-platformers have learned what will make them relevant to an audience.

Google and other search engines easily connect searchers with useful web sites when it is clear why the website is a good match for someone's search intent, so our non-platformers have invested in this kind of focus and clarity on their website.

Useful outreach is differentiated from spam by the level of relevance in who it targets and what it offers them, so non-platformers who are successful at earning visibility through outreach invest the emotional labor needed to achieve genuine relevance.

We further burden our inbox by joining an email list when it is sufficiently clear how or why the list will produce value for us. Non-platformers also invest in this kind of relevance for their email list.

Non-platformers who are successful at earning visibility have invested in learning about who (they are trying to connect with), what (is relevant to them), and why (buyers will care enough to take action). This investment and learning leads them to focus . They cannot answer the foundational questions of visibility (who, what, why) if they do not focus in some way.

If who is everybody, and what is everything, then the answer to "Why would buyers want to know about you?" is: they won't .

Focus is necessary to create relevance, and relevance is the prerequisite to visibility.

Info

- An LLM-generated summary of this book can be found here: LLM-Generated Summary Of TPMfIC

- If you'd like to chat with this book as an OpenAI GPT: https://chat.openai.com/g/g-Ct18XsNSI-indie-consultant-specialization-gpt

- If you would prefer to read this book in Amazon's Kindle ecosystem, or in print: https://a.co/d/aQztpSK

- If you would prefer a DRM-free EPUB copy of this book: https://philipmorgan.lemonsqueezy.com/checkout/buy/06f1179b-3e4a-4e63-a4ee-08c9f166fc34

- If you want to join my email list: https://opportunitylabs.beehiiv.com//)